The current COVID-19 pandemic has made the world realize that medical exigencies are inconsistent and can cause a financial trauma that is tough to deal with. With a high illness rate without a successful vaccine yet, people have begun to understand the need for owning a fantastic health insurance plan.

Moreover, with the rising cost of medical expenses, the use of a good medical centre and hospitalisation costs can be financially rigorous. For that reason, getting a medical insurance cover for your self and your family members can give the additional coverage you’ll need in times such as these.

Besides the obvious benefit of having the financial confidence to care for your own loved ones, a medical insurance plan is extremely useful in regards to beating hospital treatment inflation.

What is Health Insurance

Health insurance is an insurance product which covers surgical and medical expenses of an insured person. It reimburses the expenses incurred because of injury or illness or pays that the maintenance provider of the insured individual directly.

Types Of Health Insurance

Now, there are two basic kinds of Health Insurance :

1. Mediclaim Plans

Mediclaim or even hospitalisation plans are the most basic sort of health insurance plans. They pay the expense of treatment whenever you are admitted to a healthcare facility. The payout is made on actual expenses incurred at the hospital by filing initial bills. The majority of the plans cover the full family up to a certain limit.

2. Critical Illness Insurance Plans

Critical Illness Insurance Plans cover specific life-threatening diseases. These diseases could require prolonged therapy or possibly change in lifestyle. Unlike hospitalisation plans, the payout is created on critical disease cover chosen with the consumer and not to actual expenses incurred at a healthcare facility.

The cover provides the flexibility to use the currencies for changing drugs and lifestyle. Pay-out under these plans are made on the identification of the disease for which the original healthcare statements are not essential.

Need Of Health Insurance

In our busy lives, there is always a probability of suddenly becoming sick and requiring costly treatments. There’s always a small possibility that someone dear to us might be susceptible to a chronic condition which demands long term maintenance. Fortunately, there’s medical health insurance.

Health Insurance ensures undergoing long term treatment doesn’t throw a family to dire financial straits. By paying a little bit of premium to your insurance plan, you’ll be able to take a cover under a comprehensive health insurance program. This will shield your savings in sudden shocks of health care treatments. In this way, medical insurance acts as a protective covering for both economies and healthcare that you and your loved ones can continue to enjoy your own life.

Importance Of Health Insurance

Herceptin, a cancer drug costs roughly ₹1,10,000 for a vial of about 440 mg. Based upon the weight, an individual usually necessitates 17-19 bottles for treatment per year. That is 18 – 20 lakh solely for the medication. Add hospitalisation expenses, physician appointment prices, chemotherapy expenses, etc. Your overall expenses may transcend 25 lakhs.

Here are the 5 significant reasons for getting a Health Insurance :

1. To Resist Lifestyle Diseases

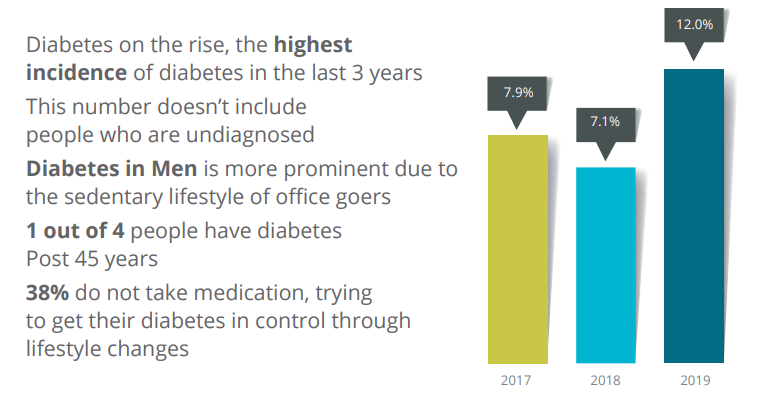

Lifestyle diseases are rising, particularly among people under the age of 45. Illnesses such as obesity, diabetes, respiratory complications, cardiovascular disease, most which can be predominant among the elderly generation, are currently rampant in younger people too.

Some leading factors which contribute to such diseases add a sedentary lifestyle, stress, pollution, and unhealthy diet plan, gadget dependence and undisciplined lives.

2. To Protect Your Loved Ones

When searching for a perfect medical insurance plan, you may opt to secure your whole family under the same policy instead of buying different policies. Think about your ageing parents, that are very likely to be at risk of disorders, in addition to dependent children. Assuming that they get the most effective treatment if anything occurs to them, is something that you wouldn’t have to stress about in the event you’ve got a suitable health cover. Research thoroughly, talk to experts for an unbiased opinion and make certain that you get yourself a plan which provides all-round policy.

3. To Take Care Of Medical Inflation

As health technology improves and diseases grow, the expense of treatment rises as well. And it is important to realize that medical expenses aren’t limited by just hospitals. The charges for a physician appointment, analysis tests, hospital prices, operation theatre expenses, medicines, room rent, etc. are also continually increasing.

Each one can put a considerable strain on your money if you aren’t adequately prepared. By paying a relatively reasonably priced medical insurance premium each year, you’ll be able to overcome the burden of medical inflation while opting for quality therapy, without fretting about how far it’s going to set you back.

4. To Secure Your Savings

While a sudden disease often leads to psychological distress and stress, there’s yet another side to coping with health problems which could render you tired — that the expenses. By simply purchasing the right medical insurance policy, you’re able to better manage your healthcare cost without dipping into your savings. In reality, some insurance agencies provide cashless therapy, and that means that you do not need to be worried about reimbursements either.

Your savings might be properly used to their intended aims, like investing in property, your kid’s retirement and education. In addition, medical health insurance enables you to get tax benefits, which further increases your savings.

5. To Counter Insufficient Insurance Cover

With the exponential growth in healthcare costs, the need for health insurance cannot be overstated. Check the price of the weekly’s hospitalized for a regular illness and then compare it along with your institution’s coverage. Most probably you’ll be convinced to buy insurance immediately. Still not sure? Think about once you grow older and might need more frequent medical attention.

Benefits Of Health Insurance

Below are 7 big benefits of buying a health care policy:

1. Money Given Upfront Without Medical Statements

Fixed benefit health insurance coverage covers the full amount on diagnosis of the disease. Yes, there’s no need to show actual proof hospitalisation and treatment, for example, hospital invoices or treatment invoices. In the event the policyholder is diagnosed with a disorder that is covered under the policy, the insurer can pay the cash to the policyholder without requesting any further questions.

2. Financial Security

With the passage of the time, the medical costs are rising and lifestyle-related illnesses such as diabetes, cancer, stroke, etc., are also surging. In such a situation, having medical insurance from today is of extreme importance as it can financially protect you against the inevitable expenses. In this manner, your savings additionally stay protected.

3. Free Health Checkup

As a policyholder, you are eligible for a no-cost preventive health check-up after an every 4 to 5 claim-free year. Some carriers also provide injectable treatments in their hospital.

4. Coverage Against Critical Disease

To take care of deadly diseases, the amount assured of a basic health insurance cover would be insufficient; therefore, insurers deliver critical illness cover being an add-on or motorcycle option.

When you look for critical disease add-in cover under your current health insurance policy, you are qualified to get lumpsum on the discovery of diseases like cancer, heart stroke and kidney failure, bone marrow transplant, etc.

5. High Cover In Reduced Price

Fixed benefit medical insurance policies give a high coverage level for a comparatively lower premium. This saves you money as well as lets you stay worry-free even though identified as having a disorder that is serious.

6. Tax Benefits

Payments made towards medical insurance are also qualified to receive tax deductions under section 80D of the Indian Income Tax Act. Individuals around 60 years old may claim a deduction up to ₹25,000 for insurance premium paid for themselves, spouse or children.

An individual can also claim another ₹50,000 as a deduction in case you buy health insurance for their parents aged 60 years and above.

7. Additional Advantages

Additionally, there are several additional medical insurance benefits. For instance, many of the plans include features including cashless asserts, ambulance policy, pre/post hospitalisation policy, NCB (No Claim Bonus), and much more. Along with reasons mentioned previously, these extra benefits further boost the importance of medical insurance.

Right Age To Buy Health Insurance

A health emergency may strike anybody, anytime and impact someone financially and emotionally. Financial advisers, therefore, indicate it is wise for those who to obtain a health and fitness plan early in your lifetime.

Listed below are the best factors to convince one to help make the order before turning 30.

1. Best Rates

In 25, a policy Rs 5 lakh policy will cost you approximately Rs 5000, at 35 you are going to need to pay out approximately Rs 6000 and in 45 the fee climbs to Rs 8000. So buy it as early as you can book the policy at the cheapest possible premium.

2. Better Financial Preparation

Buying it early is not only economical but also makes financial sense. Injuries happen with no warning and also a decent health care coverage will ensure that you are covered for emergencies and allow you to invest your hard-earned profit long-term investments.

3. Youthful Buyers Get Best Deal

Buying health insurance at a young age ensures there is no scope for pre-existing diseases as you’ll be covered early, and also any diseases diagnosed later will likely be insured automatically.

4. No Waiting Period

When you get a health plan, you’ve got to serve several waiting periods-for definite surgeries, special treatments, pre-existing illness policy, etc.. If you get it today, when usually do not need it it would mean you’d have served the prerequisite waiting periods and be in a position to claim all of the full benefits after.

Choosing the Perfect Health Insurance Plan

Now, you have decided to purchase a medical insurance policy, you will need to know just how to pick a great medical insurance plan which can look after all your requirements.

Here is a listing of advantages and also great health plan should offer you:

- Protection against a high number of critical ailments.

- Flexibility to choose your health cover plan

- No Growth in premiums during the coverage duration even though your health state affects.

- The long-term duration that insures you even in your older age.

- Enormous hospital network to get simple accessibility to clinical therapy.

We hope you might have understood now that why health insurance is important today.

One Comment

Leave a ReplyOne Ping

Pingback:Difference Between NEFT, RTGS And IMPS Explained | Wittyhutt